Investment

A high-yield natural asset for your portfolioInvesting in JC Sandalwood

Jäderberg & Cie. GmbH (JC) is the only entrepreneurial impact investor to open this unique project to co-investors as a lead investor. Besides JC, only a careful selection of international institutions (including Harvard University and Church of England endowment funds) are invested in the project.

A total of 575 hectares with 270,000 sandalwood trees, distributed over 4 locations in the north of Australia are owned by Jäderberg & Cie. Slightly more than one third of these sandalwood forests belong to JC, around two thirds to the over 1,500 private and institutional co-investors.

Usually, the investment is made via private placements. For major investors, we create tailor-made structures if required. In this respect, we are supported by our network of experts with many years of experience in the structuring of equity and/or debt investments with proven legal, tax and economic expertise. The experienced managers and staff of DFK Gooding Partners in Perth are entrusted with the operational management, such as the accounting and tax tasks of the Australian JC Sandalwood companies.

Awards

JC Sandalwood has received awards as Best Alternative Investment (2017) and as Best Impact Investment (2019).

Environmentally friendly cultivation in Australia

Since 1999, sandalwood has been cultivated in mixed forests in northern Australia by our management partner Quintis in a sustainable and socially responsible manner. This is the only way to preserve sandalwood in the long term and continue to make it usable. This is the only way to meet the demand for sandalwood in the long term.

The mixed forests have a noticeably positive and sustainable impact on the environment; their nature promotes groundwater, fauna and flora. Monocultures are strictly avoided – likewise the seeds are always free of genetic manipulation. This ensures the continued existence of Santalum album in a sustainable way and actively promotes nature and species conservation.

Commodity Monopoly

The large discrepancy between supply and demand for sandalwood has arisen in recent decades because the natural tree stocks have almost disappeared, e.g. due to illegal overexploitation in India – until now the largest supplier of Santalum album.

The selling syndicate around the Quintis managed areas in northern Australia, which includes JC Sandalwood and its co-investors, has replaced India as the traditional monopolist for sandalwood.

Notable new competitors are not foreseeable due to a well-founded and long-established knowledge advantage around the management and processing of the wood. This unique supply situation offers extraordinary opportunities: both for Jäderberg & Cie. and their co-investors, as well as for the recovery of free-growing tree stands.

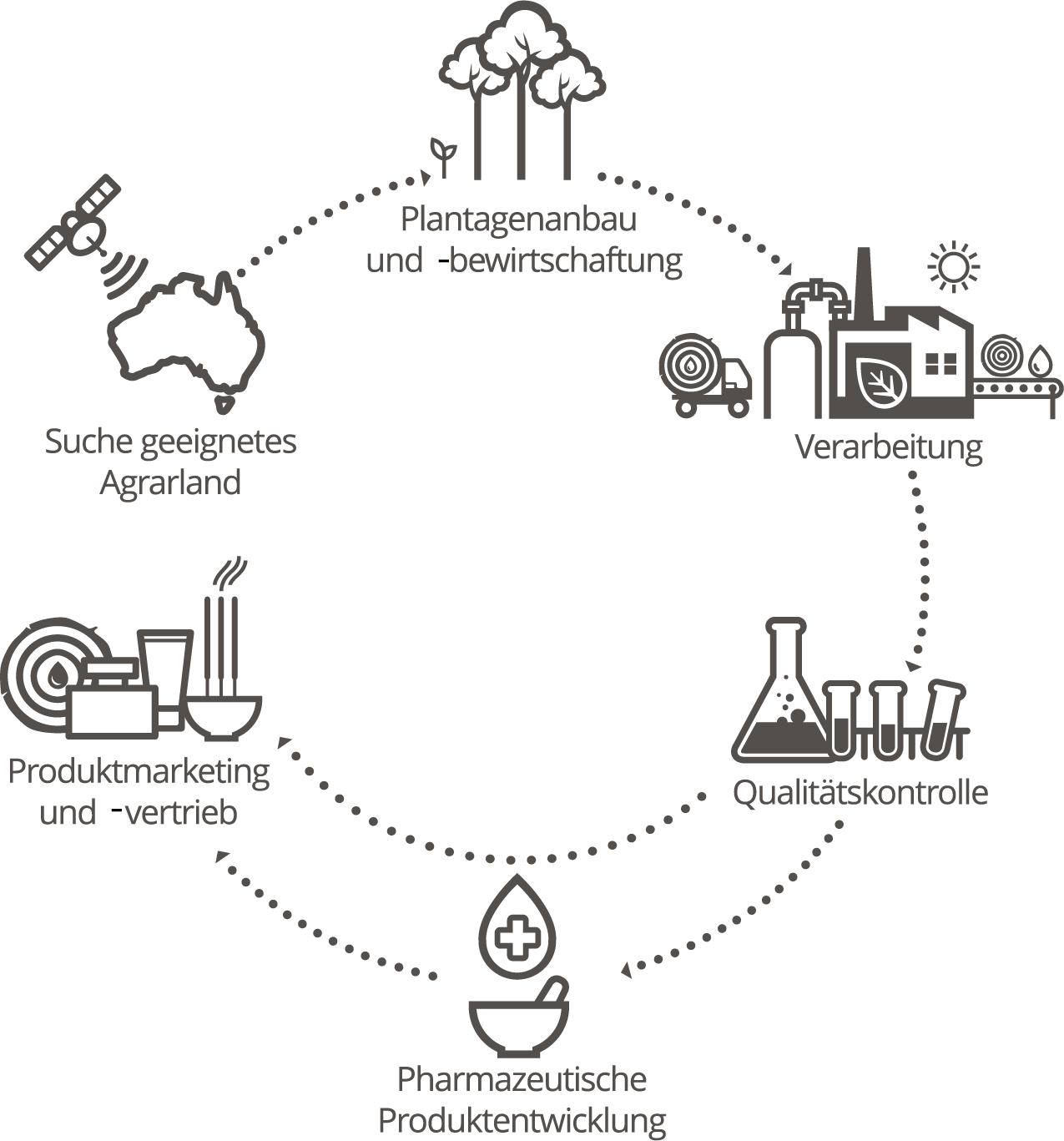

The JC Sandalwood Value Chain

Unlike many agricultural and forestry projects, JC Sandalwood aims to cover the entire vertical value chain.

To keep intellectual property protection high and costs low, own seed plantations and nurseries are operated. The Quintis research department continuously monitors the available data and evaluates it scientifically in order to optimise the growth of the trees.

Not a gram of dust is wasted: In the distillery, the sandalwood heartwood and root stems are crushed and then distilled into sandalwood oil (in pharmaceutical quality or according to customer specifications) or processed into powder.

Jäderberg & Cie. GmbH has developed the world’s first firm shampoo in 2021 that provides nourishing, protective hair care with sandalwood oil and powder. The cultivation partner Quintis also sells its own sandalwood products as prototypes for the industry.

Drug studies have been commissioned for use in human (and pet) medicine. Six clinical trials have been initiated with the FDA in the USA.

Low correlation – high portfolio growth

Sandalwood is a unique natural product in geographically and thematically diversified markets that is not traded on a commodity exchange.

This tangible asset is also unusually independent of currency fluctuations. JC Sandalwood also has a low correlation compared to typical timber investments – due to the completely different and more diversified product markets and the independence from commodity exchanges.

JC Sandalwood is an excellent portfolio balancer and enhancer due to its diversification of portfolio risks (low correlations) and its above-average financial returns.

As a prime example of new investment portfolio theory and impact investing, JC Sandalwood’s unique and massive sustainability impact is an additional key contributor to portfolio enhancement.